- Michael in Asia

- Posts

- How I pay myself while living abroad as a US taxpayer

How I pay myself while living abroad as a US taxpayer

Also Taiwan 🇹🇼 and Japan 🇯🇵 personal finance tips!

I’ve had a bit of a hiatus since my last big post about company structure and licenses for accommodation business in Japan. The end of the year and holidays have been busy! Over the past year, I’ve shifted into a different kind of life — working for myself as a fractional CTO while building up 508.dev. It’s more freedom, more upside, and also more responsibility. One of the first real questions that came with that was surprisingly unglamorous: how exactly should I pay myself? This edition aims to dive deep into that question. But first, some Taiwan 🇹🇼 and Japan 🇯🇵 personal finance tips!

Table of Contents

iPASS Money is now separate from LINE

For readers in Taiwan 🇹🇼, as of January 1, 2026, iPASS MONEY is no longer bundled inside LINE Pay.

If you’ve been in Taiwan for a while, you probably remember when iPASS Money lived quietly inside the LINE app, alongside LINE Pay. That era is officially over. The service has fully spun out into its own standalone app, and if you want full functionality going forward, you’ll need to install it separately.

The good news: this is a clean separation, not a painful one.

What actually changed (and what didn’t)

Your money is safe

Your existing balance, transaction history, and account details all carry over automatically. There’s no re-registration required—just log in using your original mobile number or ID.

LINE access still exists (but it’s limited)

There is a LINE Mini App version you can link for basic tasks like checking your balance or sending money to LINE friends. Think of it as a viewer—not the control panel. The full feature set now lives exclusively in the standalone app.

The new app is… actually better

Once you’re in the dedicated app, you’ll notice it’s no longer just a “background wallet.” New capabilities include:

Full TWQR support (Taiwan’s unified QR payment standard) at many merchants

Proper iPASS physical card management, including NFC top-ups and monthly pass purchases

Cross-border payments in Japan at PayPay-supported merchants (surprisingly useful)

A new iPASS Green Point rewards system, replacing LINE POINTS

For longtime expats, this change might feel like unnecessary friction at first—but it’s also a clear signal of where things are heading.

And that brings us to the interesting part: Taiwan’s quiet rollout of Traffic QR payments, and why suddenly your leftover iPASS balance is easier to spend than ever.

LINE Pay spun up its own wallet too

The reason for this is change is that LINE got big enough to launch its own mobile wallet, LINE Pay Money.

In short: LINE no longer relies on iPASS at all. If you want full LINE Pay functionality now, you’ll need to redo the signup process within the LINE app, complete with identity verification and its own stored balance.

Taiwan Traffic QR code payment

Starting January 3, 2026, QR-code payments are now live across most Taipei + New Taipei public transit. That means you can board buses—and even the MRT—by scanning a QR code generated from your mobile payment app.

No physical card required. Just phone → scan → go.

Where it works (and where it doesn’t… yet)

Here’s the current state of things:

✅ All regular city buses in Greater Taipei

✅ Taipei Metro(MRT)

❌ Airport MRT(not yet)

❌ Some airport buses(still card-only)

So this is very much a daily life feature, not an airport convenience—at least for now.

Which apps actually work

For buses, QR payments are accepted via:

On the MRT side, it’s a bit broader: QR fares work through TWQR-supported banks, plus wallets like E.Sun Wallet, PlusPay, and Taishin Pay.

If you already have iPASS Money set up (especially after the LINE split), you’re good to go.

Frequent rider discounts still apply (important!)

This was my big question—and thankfully, yes:

If you use QR payments on the MRT, you still qualify for the frequent rider program. Cashback is calculated the same way as before and credited the following month.

A couple of gotchas to be aware of:

You must use the same app/account to enter and exit

If your balance goes negative, you’re not getting in

Always open the app before you reach the gate—this is not the time to discover you need an update

Why this actually matters for expats

If you:

Don’t always carry your card

Prefer phone-first payments

Or just want fewer plastic things in your wallet

…this is quietly a big deal.

Between the iPASS Money app going standalone and Traffic QR rolling out, Taiwan is clearly nudging transit payments in the same direction as everything else: QR-first, wallet-agnostic, and phone-native.

A Travel QR code system on a Taiwan bus

Taiwan Metro to accept credit card payments by July 2026

Further Taiwan metro updates: you’ll be able to use credit cards or Apple Pay’s Express Transit to ride the metro as well. I’ve actually already seen the readers live in metro station gates, however they seem to be limited to Taiwan bank cards right now, as my foreign credit cards did not work.

Check your dividend payout method with Rakuten NISA

For investors in Japan, a NISA account is a great way to invest tax free. However, there’s a gotcha; as the account @gaijin_investors noted on Threads, apparently you can get taxed on dividends even inside a NISA if your settings aren’t correct.:

How to Check Your Dividend Setting on Rakuten Securities

Open the Rakuten Securities app and log in (this should work on the web version too)

Tap My Menu (マイメニュー)

Select Customer Information – Settings / Changes (お客様情報の設定・変更)

Under Product Settings (各商品に関する設定)

open Domestic Stocks ( 国内株式 )

→ Dividend Payment MethodSet it to:

「株式数比例配分方式」 (Proportional Distribution Method)

Done ✔️

This ensures your dividends stay tax-free inside NISA. This advise may also apply to other NISA providers.

💴 Free money with Tokyo app for residents

As a stimulus method for the current Japanese economy, all Tokyo area residents are eligible for a free 11000 JPY for signing up for the Tokyo App. See the official announcement in Japanese. You need a valid My Number card and you have until April 1, 2027 to claim the money. You can also link your d-point account for an extra 10% to make a total of 12,100 yen!

How I Pay Myself Abroad as a US Taxpayer

Over the past year, I’ve transitioned into working fully for myself — fractional CTO work, consulting, and building 508.dev. Freedom is great. The logistics are less glamorous.

Once you’re billing clients through your own entity — especially as a US citizen living abroad — a surprisingly practical question shows up:

How do you actually pay yourself in a way that’s compliant, efficient, and not unnecessarily complicated?

This article is about that decision. Most of it applies to anyone running their own business. But if you’re living abroad, there are extra layers: FEIE, payroll taxes, state registration confusion, retirement accounts, and deadlines that don’t care what time zone you’re in.

Why Structure Even Matters

For years while working in Japan, I didn’t think much about US business structures or retirement accounts. I was just earning income and moving on with life.

That changed once I started earning meaningful income again through consulting — a US entity. Even if your clients are overseas, if you’re a US taxpayer, structure matters.

At that point I had options:

Stay a sole proprietor

Run a single-member LLC

Elect S-Corp status

Keep it simple and accept higher self-employment tax

That’s when I started seriously looking at whether an S-Corp made sense.

Why I Landed on an S-Corp

A single-member LLC by default is treated as a sole proprietorship. That means all profit is subject to self-employment tax.

An S-Corp changes how your income is categorized. Instead of all profit being subject to self-employment tax, you pay yourself a reasonable salary that’s taxed like a normal job. Anything above that salary can be taken as a distribution, which avoids self-employment tax.

You still pay income tax on everything. Nothing becomes magically tax-free. But you’re no longer paying Social Security and Medicare on 100% of your profit, and once your income is high enough, that difference becomes meaningful.

The catch is that “reasonable salary” is not optional. The IRS expects a market-based number. This isn’t a place to be aggressive, especially if you’re living abroad and want to stay off anyone’s radar.

In my experience, this only really starts making sense once income crosses roughly $40–50k. Below that, the extra admin — payroll, filings, bookkeeping — often outweighs the savings.

The Deadline That Almost Bit Me Hard

This is the part I really wish someone had drilled into my head earlier.

S-Corp tax returns are due on March 15. Not April 15, and not “whenever you get to it because you live overseas.” There is no automatic extension just because you’re abroad, and the penalties for filing late are not small.

I learned this the hard way and am currently dealing with an IRS penalty of $245 per month, per shareholder, for every month the filing was late. Yes, that still applies even if you’re the only shareholder. I’m in the process of requesting a waiver, but it’s not something I would ever want to rely on again.

If you’re going to run an S-Corp, put March 15 on your calendar and treat it as non-negotiable.

How I Pay Myself and Run Payroll (Without Overthinking It)

Even if you’re the only employee, an S-Corp requires running real payroll. I use Gusto’s Solo plan, which runs about $49 per month plus $6 for one employee (yourself). It does exactly what I need and nothing more. There are other payroll providers that may be cheaper, but I like Gusto as the UI is well designed and they have great customer support.

One thing worth calling out: Gusto automatically enrolls you into priority support, which is an extra ~$33 a month. If you’re a solo founder and not constantly calling them, you almost certainly don’t need it. I caught this 2 months in and unsubscribed, and went through support to get a credit for the extra charges.

This is my referral link for Gusto if you’d like to support this publication!

The Unexpected Benefit: Retirement Accounts After Years Abroad

One of the biggest upsides of running my own company again wasn’t actually tax savings — it was realizing I could finally contribute meaningfully to US retirement accounts.

After spending years working in Japan, I hadn’t contributed to any US retirement accounts in a long time. Once I started earning consistent contractor income again, I realized something important: as long as you have self-employment income, you can open a Solo 401(k). You don’t need an S-Corp or even an LLC for this. You just need earned income from your own business activity.

With a Solo 401(k), you effectively wear two hats. As the employee, you can contribute up to the annual limit (around $23,500, depending on the year), either Roth or traditional. As the employer, your business can contribute up to roughly 25% of your salary if you’re an S-Corp — or roughly 20% of net profit if you’re a sole proprietor.

This is where structure matters. An S-Corp doesn’t create eligibility, but it can change the math. Employer contributions in an S-Corp are based on W-2 salary. In a sole proprietorship, they’re based on adjusted net income after self-employment tax. The formulas differ slightly, but either way, this structure allows a solo operator to put away far more than a normal IRA would allow.

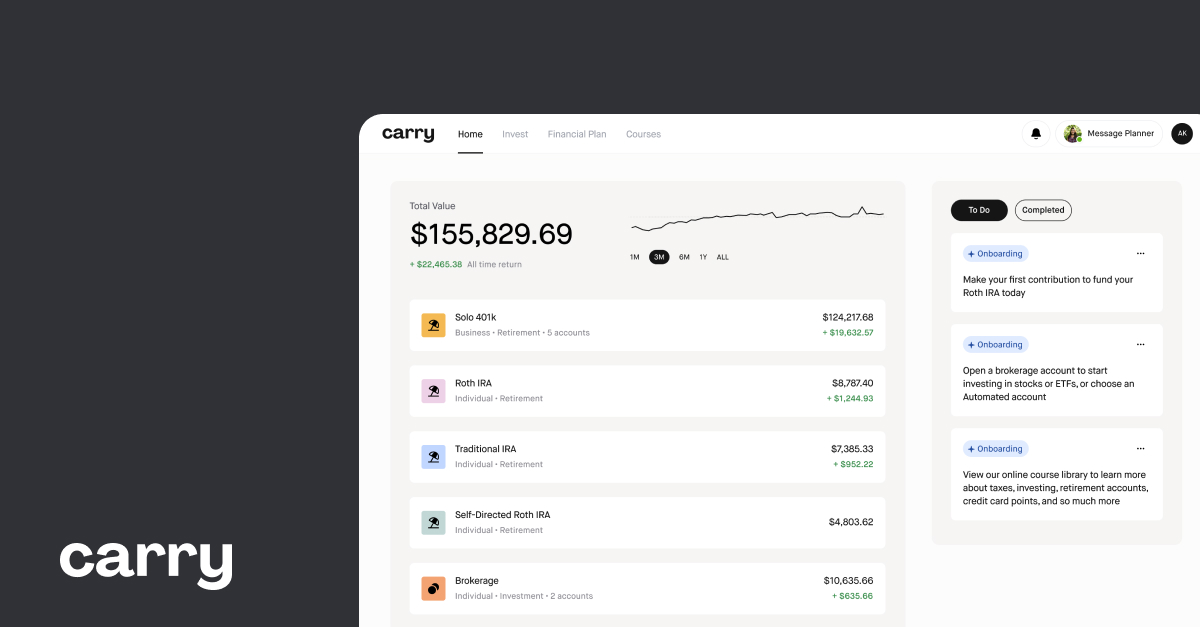

I use Carry to manage my 401(k). Their Core plan is $29 a month or $299 a year and covers Solo 401(k)s, IRAs, and taxable brokerage accounts. It’s significantly cheaper than bundling everything through payroll providers, and I prefer keeping retirement separate from payroll. Gusto offers Guideline as an integrated provider as well through it is more expensive, and I didn’t find it bothersome at all to just do everything through Carry.

There are also tax credits available for setting up a retirement plan, which can offset some of the cost in the first few years. It’s one of those incentives that doesn’t get talked about much but makes a difference.

Yes, You Can Still Claim FEIE With an S-Corp

One thing I didn’t fully appreciate at first: having a US S-Corp does not automatically disqualify you from the Foreign Earned Income Exclusion (FEIE).

If you qualify under either:

The Physical Presence Test (330 days outside the US in a 12-month period), or

The Bona Fide Residence Test,

you can still exclude foreign earned income — even if that income is paid to you by your own US S-Corp.

But there are some important nuances.

What Actually Qualifies

The FEIE applies to earned income, meaning wages or salary. In an S-Corp setup, that means:

✅ Your W-2 salary from your S-Corp can qualify

❌ Your distributions do not qualify

Distributions are business profit. They’re not considered earned income, so they can’t be excluded under FEIE.

So if you’re running an S-Corp abroad, the FEIE only shields the salary portion of what you pay yourself.

Where It Gets Subtle

FEIE doesn’t care where your clients are located. It cares where you physically perform the work.

If you’re living abroad and doing the work there, the income can be considered foreign earned income — even if:

Your clients are American

Your LLC is American

What matters is that you, the human performing the services, are outside the US when doing the work.

That’s the key distinction.

So in my case, even though I bill both US and foreign clients through a US LLC, the income can still qualify for FEIE because I’m physically outside the US while doing the work.

What This Looks Like at $60k vs $200k

Example 1: $60,000 Net Profit

Your S-Corp earns $60,000.

You decide a reasonable salary is $50,000.

The remaining $10,000 comes out as distributions.

If you qualify for FEIE:

The $50,000 salary can potentially be excluded from federal income tax.

You still owe payroll taxes (Social Security + Medicare) on that $50,000.

The $10,000 distribution is taxable income, but not subject to payroll tax.

At this income level, FEIE likely eliminates most or all federal income tax on your salary. But you’re still paying payroll taxes, the S-Corp administrative overhead may offset the savings. This is where the math often feels marginal.

Example 2: $200,000 Net Profit

Your S-Corp earns $200,000.

You pay yourself a $120,000 salary.

You take $80,000 in distributions.

If the FEIE limit is around $120,000:

Your salary may be largely excluded from federal income tax (up to the limit).

Payroll taxes still apply to the $120,000 salary.

The $80,000 distribution is fully taxable income, but not subject to payroll tax.

Now things get more interesting.

You’re avoiding federal income tax on up to ~$120k of salary through FEIE.

You’re avoiding payroll tax on $80k of distributions through the S-Corp structure.

You’re still paying payroll taxes on the salary portion, and the distributions are still subject to federal income tax. Nothing is magically tax-free. But the combination can be meaningfully efficient at higher income levels.

Important Tradeoffs

There’s a strategic layer here.

If you exclude most or all of your salary under FEIE:

You still owe payroll taxes (Social Security & Medicare)

But you may owe little or no federal income tax on that salary

Distributions remain taxable income

This means the S-Corp + FEIE combination can still make sense, but the math changes compared to someone living in the US.

Also, if you use FEIE, you generally can’t also take the Foreign Tax Credit on that same excluded income. So it becomes a planning question depending on where you’re resident and what you’re paying locally.

This is where things move from “blog post” into “talk to a cross-border CPA.”

Company Formation

Once you decide to set up an LLC and elect S-Corp status, the first real decision is which state to form in.

You’ll hear Delaware mentioned constantly, especially in startup circles. Delaware has well-established corporate law and is great for venture-backed companies, but it’s not automatically the best choice for a solo operator. There are annual franchise taxes, filing requirements, and other overhead that may not make sense if you’re just running a one-person consulting business.

There are several solid states to consider depending on your situation (you can read this article for options). In my case, I chose Wyoming because it has low annual fees, strong privacy protections, and no state income tax. For a solo operator without investors, it’s clean and simple.

Since I live and operate entirely abroad, I don’t need to register as a foreign LLC in another US state. If you’re physically living and working in California, for example, forming in Wyoming won’t save you — you’d still need to register in California and comply with their rules. But because I don’t live in any US state and perform all services overseas, Wyoming works well for me.

To form the company, I initially used Northwest Registered Agent. They have a good reputation and the setup process was straightforward, with a choice of states to register in. Later, when I needed mail forwarding and a virtual office lease, I switched to Rocky Mountain Registered Agent because they were more affordable and still had solid service. I plan to move my registered agent service fully over to them going forward.

For expats, the key consideration isn’t just “what’s the cheapest state,” but whether you actually have a physical nexus in any US state. If you don’t live or operate in one, that opens up more flexibility in where you form.

Electing S-Corp Treatment

Forming an LLC does not automatically make you an S-Corp. By default, a single-member LLC is treated as a sole proprietorship for tax purposes. If you decide the S-Corp structure is worth it, you have to formally elect it with the IRS by filing Form 2553. You can only do this by mail unless you pay an agent to file for you.

The timing matters. Generally, you need to file Form 2553 within two months and 15 days of the start of the tax year you want the election to take effect. For most people operating on a calendar year, that effectively means by March 15. Miss that deadline, and you may not get S-Corp treatment for that year unless you qualify for late-election relief.

It’s a simple form, but it’s not automatic — and it’s separate from forming the LLC at the state level. State formation and federal tax classification are two different things.

The Wyoming Employer Registration Confusion

Another odd thing I ran into: Gusto kept prompting me to register for Wyoming unemployment insurance and state employer accounts.

So I tried. Wyoming basically told me: you are not a liable employer.

Declined!

Which makes sense. I don’t live in Wyoming. I don’t live in the US. I have no US-based employees. I’m physically working abroad.

State unemployment systems are generally based on where services are performed. If the services are performed entirely outside the US, you typically aren’t subject to state unemployment insurance in that state.

Gusto, being software, assumes “Wyoming S-Corp = Wyoming employer registration.” But reality is more nuanced when you’re permanently abroad.

The result: I didn’t need to register, and Wyoming confirmed that.

This is one of those small but annoying mismatches between payroll platforms built for domestic businesses and the reality of running a US entity while living entirely overseas.

The Honest Take

An S-Corp is not a hack, and it’s definitely not free money. It’s a trade-off between tax efficiency and administrative overhead. Once your income is high enough and stable, it can make a lot of sense. Before that point, it’s usually just extra complexity.

If you’re living abroad, the stakes are a little higher because deadlines don’t move just because you’re in another time zone. If you’re going to do this, do it properly, set reminders, and assume the IRS will not cut you slack by default.

Conclusions

I hope this run-down is informative for any US-taxpayers running their own global business while living abroad! You can always reach out at [email protected] for comments or questions! Remember, you can also support this publication by becoming a paid subscriber or a Patreon!

Reply